Not much to say today other than fear continues to dominate the market. Watching the last hour before the close is like watching the ball bounce around on a roulette wheel. Will it be black or red? Who knows!

I don't think anyone has a clue which direction the market will break at the end of each day. We rise and fall hundreds of points every few minutes. Anyone that went long Thursday or today was sweating bullets near the close as we dropped two hundred points around 3:30 before bouncing back 100 right at the bell. Those on the short side have been sweating bullets all week after taking big losses!

This results in high volatility because there is a ton of fear selling from each side. Many of the bulls and bears prefer to sell on Friday because neither side knows what potential ghosts or goblins could be released from a news perspective over the weekend. In this type of market, holding over a weekend can be suicide!

One thing that was interesting today was JP Morgan announcing they are going to start modifying mortgages:

"Oct. 31 (Bloomberg) -- JPMorgan Chase & Co., the largest U.S. bank by market value, plans to modify terms on $110 billion of mortgages and forgo foreclosure proceedings on all real-estate loans while the changes are implemented in the next 90 days.

The offer extends to customers of Washington Mutual Inc., the savings and loan JPMorgan agreed to buy last month, the New York-based bank said today in a statement. Loan modifications may include interest-rate or principal reductions. The bank said it will establish 24 regional counseling centers to provide face-to- face help in areas with high delinquency rates.

The JP Morgan program is expected to help 400,000 families with $70 billion in loans in the next two years, JP Morgan said. The company said an additional 250,000 families with $40 billion in mortgages have already been helped under existing loan- modification programs.

The programs are aimed only at homeowners who ``show a willingness to pay,'' the bank said. ``Customers should continue to make mortgage payments to reflect their intent to honor their commitments.''

JP Morgan said it will also donate or offer a ``substantial discount'' on 500 homes to community groups in order to stabilize local markets. "

Final Take:

If this doesn't have disaster written all over it than I don't know what does! Why would anyone pay their mortgage regardless of whether they can afford it or not? If I overpaid for a $600,000 McMansion, I would be the first guy calling JP Morgan to get my bailout.

I'll "show a willingness to pay" JP! Just drop my mortgage by 200,000k. This is going to be a disaster for the banks if they decide to go down this road. Where do they draw the line in terms of who gets a modification and who doesn't?

If you are struggling to pay your mortgage, I would be taking advantage of this immediately whether your loan is with JP Morgan or not. My guess here is there is some serious political pressure being put on these banks to "lighten the load" for homeowners by the Treasury.

Washington is now deeply worried about torches and pitchforks. Homeowners are ANGRY as they watch Wall St get bailed out while they continue to struggle.

Bottom Line:

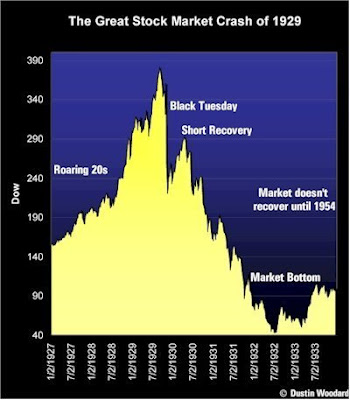

Folks, this whole nightmare is starting to unwind at a frantic pace. The government is trying to juggle too many balls at once as it tries to prevent a multi trillion dollar debt bubble from unwinding.

This is a house of cards that is about to come tumbling down. The government does NOT have the money to prevent this unwind from happening! They are going to end up defaulting on themselves if they continue this bailout mentality.

The Treasury announced this week that they are going to be forced to run $2 trillion in treasury auctions in order to try and pay for this fiasco. You can be sure that the demand for all of these new treasuries is going to be tepid at best. Yields will have to be raised in order to get it all sold. We all know what that does to lending rates. To the moon Alice!

I mean think about it, why would you risk buying the debt of a nation that is filled with a bunch of consumers that have no savings and are in debt up to their eyeball?.The T-bills will get sold but it will be at a price.

When these yields go through the roof, expect equities to swirl down the toilet bowl.

As for the market short term, good luck! My advice is to avoid it unless you have a very strong stomach. The bounce this week looks tired but we have the election on Tuesday. There is a lot of debate as to what happens to equities depending on who wins.

You would think an heavy taxing Obama victory would be bad for equities, but Wall St seems to be pulling for him so I wouldn't take that bet.

I plan on taking a breather here and hold onto my current positions until the election shakes out.

In terms of trades I hedged myself a bit today. I picked up some UYG and sold some of my short 2x inverses. I am still hedged to the short side but more protected from volatility. I also picked up some SRS today. This has pulled way back from its highs and I think commercial real estate is going to get killed during this downturn.

Happy Halloween!