Good Evening Folks!

Warning! This is gonna be a long one!

I thought we could talk about the Fed along with some trades tonight. Trading wise, I went almost completely flat today and took everything off. Sometimes you need to take a deep breath, reflect, and re-evaluate as to where we are in this big bad bear market.

Let me share my trading day today:

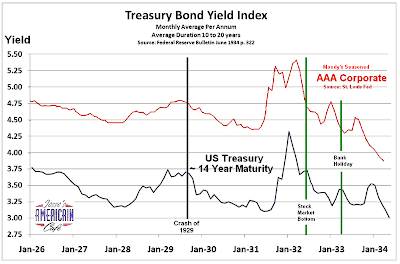

First of all, I closed out with a mild loss overall. I sold my TBT(short treasuries) this morning at a loss because I am tired of getting manipulated by Ben's constant threat of buying treasuries(more on this later). This trade just isn't working right now because there is too much uncertainty in the bond market. Yields are fluctuating violently as the bond traders try to react to constant Ben's threats of buying the long end. I could have timed the selling of this better because TBT came back nicely later in the day after the Fed announcement. Oh well! It certainly wasn't be the first time nor the last time that I will make this mistake.

I also sold my short on SPG which is a large REIT this morning at a mild loss. I was glad that I dumped this early because this dog soared later this afternoon. I also dumped some(not all) of my SRS figuring that I could buy it back cheaper down the road. On the positive side, I sold some SSO(long S&P) and some QQQQ(Large cap tech) calls at a nice profit. I always try to stay hedged folks. You have to be in this market.

Fighting the Desperate FedThis is the big dilemma folks. The old saying "Don't fight the Fed" is certainly ringing true right now as the economy falls off cliff. I kinda compare the current Fed to a Rabid dog that's been totally cornered. It looks like the "Cujo" Fed is getting ready to bite as the debt bubble continues to deflate despite their best efforts. This makes the Fed and its balance sheet extremely dangerous especially if you are on the short side.

The Fed is desperate because they are basically out of bullets:

My Take:

As a result, the Fed will now be forced to take drastic alternative actions because they are basically out of options when it comes to interest rate policies.

So what can they do? Well they pretty much told you in their statement today:

"WASHINGTON (Reuters) - The Federal Reserve on Wednesday said it is prepared to buy long-term government debt if that would help improve credit conditions and signaled some concern that deflation risks were rising.

In a statement issued at the end of a two-day meeting, the central bank's policy-setting panel also said it was holding its target range for overnight interest rates at zero to 0.25 percent -- the level reached in December -- and repeated that it thought rates could stay unusually low for some time.

"The committee ... is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets," it said. In December, the Fed had said only that it was studying that option.

The panel voted 8-1 in support of the decision. Richmond Federal Reserve Bank President Jeffrey Lacker dissented, saying he thought the Fed should immediately move to a program to purchase government bonds.

U.S. government debt prices fell sharply, suggesting investors wanted a clearer sign the Fed would become a buyer of bonds. Stock prices added to gains and the dollar rose.

With benchmark overnight rates virtually at zero, the Fed has turned its focus to what Chairman Ben Bernanke has dubbed a "credit easing" approach that targets specific assets and markets in the hope of restoring normal lending.

"Basically they are opening their wallets and are ready to start buying more assets and extend that if necessary," said Kurt Karl, head of economic research at Swiss Re in New York."

Continued Take:

Can you say desperation? This is a sad and scary statement from the Fed: The fact that they are willing to buy their own treasuries shows you how dire the situation really is out there.

Lets think about this for a second folks. Essentially the Fed is announcing that they are ready to buy their own treasuries in an attempt to keep interest rates low and thus stimulate lending. Treasuries are what we sell in order to finance our debt.

So, essentially what this means is our government is spending money that we don't have and we are financing it by selling treasuries to ourselves. Huh???? Are they really serious?

This is a friggin joke!

What will our foreign debt buyers think about the value of our treasuries when they start watching our country finance itself by buying its own debt? I can answer that Alex: They will run away from treasuries as fast as they can!

This would then leave the Fed bidding against themselves for treasuries in the bond market. Can you say circle jerk? How long do you think they can sustain this game as the government continues to spend trillions of dollars on massive bailouts?

The Feds balance sheet is already at $1 trillion dollars which is way more than anyone is comfortable with folks. If they attempt the treasury buying game its over. They might be able to do it for a short period of time before they blow themselves up but the end result is a certainty. There is simply too much debt that needs financed, and the Feds balance sheet is way too small to fund it.

This is why to date Ben has only threatened to buy treasuries. I don't think he is actually stupid enough to pull the trigger. If he ever pulls it, run to the bank and grab cash as soon as possible.

Bottom Line:

Contrary to what the market is telling you, things are bad and getting worse. This idea of the Fed buying all the bad assets from the banks without severely punishing or nationalizing them is a pure fantasy. It sounds like they are going to try to pull it off but it won't work. You can bet your bottom dollar that the banks will try to dump this mess completely onto the taxpayer. Lets hope our government is smart enough to stop it.

As you can see below, this banking crisis is a mess and its going to take hundreds of billions if not trillions in order to clean this up. These banks are completely insolvent:

Reuters is reporting today that the banks need hundreds of billions more dollars in order to stay solvent.

"WASHINGTON (Reuters) - Weakening U.S. banks will probably need hundreds of billions of dollars in additional funds beyond what has already been approved for the Troubled Asset Relief Program, the head of the non-partisan Congressional Budget Office said on Wednesday.

"I think the gap that remains in terms of the recapitalization needed by the banking system exceeds the amount of money left in TARP, I think by a good margin," Doug Elmendorf told the Senate Budget Committee.

While some of this capital could and should come from the private sector, "the odds are that more money will be needed than has been authorized so far in the TARP, probably to the tune of hundreds of billions of dollars," Elmendorf said.

Massachusetts Democratic Sen. John Kerry said more help for the banks from the government should be conditioned upon reforms. "You may even have to have some agreement as to change of management and other things," he told Reuters in an interview.

"You need to have an agreement from those banks that they're going to change their approach, they're going to write down their toxic assets, they're going to live by a new regulatory set of standards," Kerry said.

"There's a tough trade-off," Elmendorf said. "We can wait for the banks to fail, and then in a sense we get (the assets) automatically."

"We don't want to benefit the managers who made bad decisions," Elmendorf added. "On the other hand, if we let them stew in their own mess, we run the risk of driving the economy further into the ground."

U.S. policy-makers should move quickly, he said.

"As the financial system is rebuilt, private creditors will have to take some losses; and some banks may have to fail: It is neither necessary nor desirable for government to take on all the losses from bad assets," he said.

The CBO offers non-partisan analysis on the costs of U.S. government spending programs."

Trading:

Isn's it amazing that bank stocks can soar when reports come out like this explaining how insolvent they are?

So whats a trader to do? We now have a desperate Fed that's doing everything in their power to help out their buds at the banks. This has ignited a massive rally in the financials. The bulls are out there screaming "the bad bank is here we are saved!". Uhhh..NOT! Anyway, bank stocks are up 6 consecutive days. Gee do you think this "bad bank" idea was leaked to Wall St? Crooks!

This all being said, I would not be surprised to see a pullback over the next couple days. However, I am going to avoid trying to trade this sector. Fighting the Fed at a time when they are about to sink probably isn't a very good idea so I will head to other sectors.

I think the jobless claims number will be hideous tomorrow. I also predict that you will see a little profit taking as well. Prudential is up 100% since this rally started folks! Now is not the time to be a pig! As a result, I think we are in the red tomorrow.

I bought some QQQQ PUTS near the close. Shorting financials here is too risky in my view so I will play the pullback in other sectors like tech. I also may buy some SDS depending on the futures and the jobless claims number. I also will consider daytrading SRS tomorrow. Seeing this ETF sitting in the 40's is simply too tempting.

One other thought about today: The fact that the market could only muster a 200 point rally in severe oversold conditions after the bad bank news and a gift statement from the Fed has severly increased my suspicion around this rally. This could and should have easily been a 400-500 point day given the news.

I plan on playing small with tight stops. We could see a continuation of today so caution must be used.. I will also close out my positions before the bell because GDP comes out on Friday. This one is one giant wild card and I have absolutely zero desire to try and front run it.

There will be a time to fight the Fed folks and short financials. Unfortunately, I think this rabid dog still has some bite left.