Saturday, November 15, 2008

Ron Paul on the G-20 Meeting

Take a look at this excellent commentary from Ron Paul on the upcoming G-20 summit:

Quick Take:

Ron Paul makes some great points here. The dollar is strengthening because the world owns so much of it. I think this is really starting to bother the ROW. I would not be surprised at all if the world eventually develops another currency that's stable enough to rival the dollar.

Many countries are outraged by the fact that we created this economic crisis and our currency is now benefiting from it. AS the worldwide recession continues to deepen, countries will become more and more motivated in creating an alternative currency.

Inflation is starting to creep into my radar folks. The deflation story still has legs, but all of the bailouts and currency disruptions in the world markets are increasing my worries over inflation. Grabbing some gold as a hedge is starting to look like a very good idea.

Friday, November 14, 2008

"AAA" Spreads Explode: Market Freefalls at the Close

What a close today folks! The markets looked like a waterfall as stocks plunged in the final 20 minutes of trading. The DOW and NASDAQ fell 3.9% and 5% respectively.

The markets continue to be extremely jittery and highly volatile. The $40 move in gold today was indicative as to how nervous the market is right now. Whats even more alarming is what is going on in the credit markets. take a look at what "AAA" spreads have done the past few days:

My Take:

My Take:Folks this is insane! The spreads on "AAA" rated debt have exploded higher in the last couple days. This is supposed to be the highest rated debt out there. The credit markets are basically telling you that they don't want to touch this stuff with a 10 foot pole. This isn't supposed to happen with AAA rated paper! The bond market has been screaming "warning! warning! warning!" all week and yet the equity markets continue to ignore them.

Remember folks, the brains in the credit markets dwarf those of the "bubble" pigmen in the equity markets. Another little known fact is the credit markets are 5x larger than the stock market. Thats a lot of smart money! You are much better off as an investor listening to Rick Santelli in the bond market on CNBC versus plugging your ears as Jim Cramer screams buy buy buy over in the equity markets. All day long the pigmen call bottoms or tell you to" be defensive and buy consumer staples". Gee, what a brilliant strategy. Hows that working for you? Last I saw, Proctor and Gamble is down $10/ share from a year ago.

I wouldn't be surprised if the "AAA" spread blowout is why we dumped so hard today. Stocks cannot continue to ignore all of the bad news in the credit market and the economy. I mean look at how bad October retail sales were:

"Nov. 14 (Bloomberg) -- Retail sales and prices of goods imported to the U.S. dropped by the most on record, signaling the economy may be in its worst slump in decades.

Purchases fell 2.8 percent in October, the fourth straight decline, the Commerce Department said today in Washington. Labor Department figures showed import prices dropped 4.7 percent, pointing to a rising danger of deflation, and a private report said consumer confidence this month remained near the lowest level since 1980.

``The weakness in growth is intensifying and inflation pressures have evaporated,'' said James O'Sullivan, a senior economist at UBS Securities LLC in Stamford, Connecticut, who accurately projected the decline in sales. ``Deflation is a word that will be increasingly used over the coming months.''

Final Take:

I am not surprised we saw no follow through on the big bounce yesterday. The October retail data is horrendous. Company after company continues to warn and lower guidance. The export price drops in the October retail data were the largest drops that have ever been seen! You think China is going to keep buying treasuries when they have to give away their exports to us for nothing? HAH!

The data is bad and getting worse by the day. You simply can't have sustained rallies in this type of environment. We also haven't seen any capitulation selling that always marks any type of bottom. The early week selloff was way to orderly to mark a bottom.

The only bottom that I will believe in is one in which the DOW capitulates and crashes 1000-1500 points in one day, sells off again the next day and then reverses. You must see a day of total fear in which psychologically everyone wants to get out of stocks all at the same time. Only then will the selling be exhausted.

We haven't seen this folks. We haven't seen anything that's been even close. The increasing credit market spreads on prime paper seen above are absolutely frightening. This is a potential "Mt St. Helens" type explosion that could burst in the credit markets at any moment. Having a high exposure to equities at this point is suicide with the spreads out this far.

Could we still stay in denial and continue to ignore the danger that the credit markets are trying to warn us about and stay flat or move higher? Sure..Nothing would surpise me in this "bubble" market.

I believe one of the reasons we haven't seen capitulation is many "clueless" financial planners continue to tell their clients to stay in equities. They tell their clients "remember, you are in it for the long haul". Yeah ok, did they also tell them that if their portfolio drops 50% they then need stocks to move up 100% in order to get back to even? I bet they forgot to tell them that part. Anyone see a catalyst that sends markets 100% higher in the near future? Yeah me either.

How are these clients going to feel if we drop another 20% from here? They will be lucky to get back to even by the time they retire. Its time to take ownership of your future folks! Buy and hold for the long term simply doesn't work anymore. Find a new financial planner if this is his advice.

Bottom Line:

The credit markets can't be ignored forever. One day we are all going to wake up and realize that a lot of "AAA" paper is almost worthless. God help you if you are "all in" in equities when this day arrives.

Things continue to get worse folks, and my trading positions have stayed the same and reflect this.

Thursday, November 13, 2008

Boing! The 2002 Lows Hold

Well we got our answer today on the retest. The 2002 lows held! The reason for the bounce today was purely technical here folks. We knew that one of two things was going to happen today when we got to around 820 on the S&P(2002 lows):

A. We were going to break through the lows and head into the abyss.

B. The 2002 lows were going to hold and stocks would go parabolic on the long side.

The market chose B for now! Folks, this move means nothing from a long term perspective. All it tells you is how sick and desperate the market is. Investors are completely bi-polar right now. They are terrified to miss the next great bull market. At the same time, they are also terrified that they may lose all of their money. This results in a bunch of volatile trading that means nothing from a fundamental standpoint.

The big boys(hedgies, investment funds etc.) all jumped in and bought the technicals when we hit retested the lows this morning. The rest of the afternoon, Wall St basically turned into a feeding frenzy as everyone piled in thinking that this is the bottom. The shorts of course started covering like crazy in the process which exacerbated the move and before you know it... POOF! We had a 7% up day. Umm.... question here: Haven't we seen this show before?:

Note that as of today, we have seen three parabolic moves upward from the lows as the DOW continues to skim along the bottom at around 8000. As you can see above, the first one occurred in early October followed by a second one in late October. Both of the retests failed miserably. I see no reason why this one won't do the same.

I say this because the news is only getting worse, and the fundamentals continue to deteriorate. More importantly, we had a poor treasury auction today:

"Highlights

Demand was poor for the Treasury's 30-year bond auction where the stop-out rate of 4.310 percent was nearly 10 basis points over the 1:00 bid. The bid-to-cover ratio was soft at 2.07. Reaction was swift as money moved out of the Treasury market in response.

Results of the quarterly refunding were mixed showing strong demand for Monday's 3-year note sale, mixed results for yesterday's 10-year auction and poor ones for the 30-year bond. Strong demand is a vital for the Treasury which is facing a mountain of borrowing needs."

My Take:

I warned earlier this week that if treasury demand drops off significantly going forward, the game is over. We got a warning shot accross the bow today that demand already is starting to weaken. Yields soared on treasuries as word got out about the poor treasury demand for the 30 year auction held today. Here is a chart of the yields on the 10 year today. Mortgage rates will be rising as a result. That will do wonders for the housing market. NOT!

I can't stress how important this is to watch folks. The Fed/Treasury is going to be forced to sell Trillions of dollars in treasuries in order to pay for the bailout of America. they are going to need the best salesman in America in order to get this done. Maybe they can bring Chris Farley back from the dead and use "Tommy Boy" to sell these trillions of government IOU's!

Folks, if demand for treasuries is already starting to become poor, whats demand going to be like as the world recession deepens and our foreign debt buyers need to start spending their money at home like China announced earlier this week?

There is only so much money to go around in the world. More and more countries are going to be be forced to spend their national funds feeding their own people and trying to fix their own economy as this recession deepens. If they don't do it, governments will find themselves out of power as their fellow countrymen rise up. We all know politicians are all about getting re-elected and staying in power! Demand for treasuries is going to fall off a cliff folks! We got some proof of this today as noted by the auction above.

Bottom Line:

Try to keep a steady hand as you try and navigate through this market. Its very easy to let emotions get the best of you in situations like this. These moves do nothing but tell you that the market is sick. There is no bull market that's going to take us back to DOW 14,000. Today's move was based on panic not optimism.

The odds IMO are much greater that we will eventually break the 2002 lows. One thing I am going to watch right now is how far we bounce back on this move. Notice that the last two times we moved higher, the move died right around 9500. I think it will be very bearish if we don't get back up there on this bear market rally.

As for trading positions, I got rid of some of my shorts and took profits the last few days. I am still holding onto some SDS and QID. This move doesn't mean a whole lot in my view and I don't have a problem holding onto these. This move was way too violent and was based purely on emotion. It could very well be a one day rally. However, we may see some follow through tomorrow and Monday on any potential good news coming out of the G-20 summit this weekend.

I bought some TBT today because I think think treasuries are going much lower.

That's all for now. Watch the bond market folks. They are starting to get a little bothered by whats going on.

Stay Tuned.

Tuesday, November 11, 2008

Stocks Continue to Weaken: Retest Likely

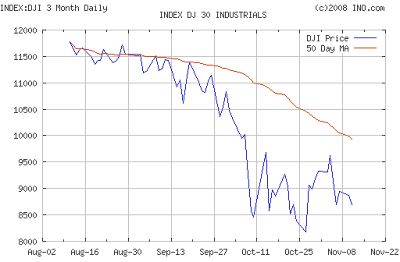

It was another red day on Wall St! The major averages were down about 2%. The charts tell me that its highly likely that we are going to retest the lows. Take a look a 3 month chart of the DOW:

As you can see, we hit the closing low of 8175 in late October. Technicians will tell you that the fact that the bounce up to 9500 didn't hold means that a retest of the 8175 low set in late October is very likely before we move higher.

Here was Art Cashin's take in his daily newsletter this morning(no link, subscription only):

"Cocktail Napkin Charting –

The market continues to offer conflicting alternatives (that's its job, of course). Look at the wicked selloff last Wednesday and Thursday.

Not only was it the worst two day "point" fall in history, they had other rarely seen aspects. As the fabled Bob Farrell points out, they were the first back to back 90% days since 1987. He also notes that both days had Trin readings well over 2.00 (3.88 and 4.06). We have not seen that since the bottoming process back in 2002.

This continuing confluence of rarely seen performances suggests something very powerful is about to happen.

Okay, let's review. Most of the napkins lean toward a probable retest in this bottoming process. To eliminate that likelihood, the bulls would need to rally above 9750. That's a long way off. The bears have a nearer test of direction.

If stocks break Friday's lows (Dow circa 8650 and S&P 900) that could put bears back in the catbird seat.

Additionally, the moving averages have yet to cross each other favorably. Thus, they have yet to verify that a bottom has been put in.

For today, S&P needs support at 907, then 900 and then 880. Resistance looks like 930 then 951. Consensus –

Today's holiday should keep markets illiquid and, therefore, potentially volatile. Stay very, very nimble. Something's building here."

My Take:

I don't know a better trader on the street than Art Cashin. I will take his 5 decades of experience over anyone so I pay close attention to what he says. I thought his writings today were very interesting. Keep in mind this was from this morning so now we can break this down a little further:

Based on his comments above, Art said the bears should be in the catbird seat if we broke 8650 on the DOW and 900 on the S&P. We ended up closing at 8693 and 898 respectively so we broke thru one of the two supports and came very close on the other.

This makes me lean towards another push down to retest 8175 on the DOW before we move higher. Now keep in mind, this was not completely confirmed according to Cashin's cocktail napkin charting so you need to be careful if you are going to play to the downside.

I ended up closing out my SRS today and took some profits, but I kept everything else on. These retests are critical to where we go next. I find Art's prediction that something very big is building to be very ominous.

My guess is if we break through the 2002 lows of 820 on the S&P that things could get very ugly. The bulls would then run for the hills selling on the way out because technically this would a complete failure.

On the bullish side, if the 8175 level holds, we could see a rocket ride north. We are within a day or two of retracing to these levels so you gotta be nimble over the next couple of days as Art warns. We could test the lows tomorrow the way the DOW has been trading so pay attention! We have seen several 600 point down days in the last few months. Another one tomorrow would bring us right to the retest levels.

Bottom Line:

Things were quiet on the news front. The big news was the loan modification program that was announced by the government.

"WASHINGTON (AP) -- Once again, the government has offered another plan to help troubled homeowners. Once again, critics say it doesn't go far enough.

The plan announced Tuesday by federal officials and mortgage giants Fannie Mae and Freddie Mac sounds sweeping in its approach: Borrowers would get reduced interest rates or longer loan terms to make their payments more affordable.

To qualify, borrowers would have to be at least three months behind on their home loans and would have to owe 90 percent or more than the home is worth. Investors who do not occupy their homes would be excluded, as would borrowers who have filed for bankruptcy.

Qualified borrowers would get help in several ways: The interest rate would be reduced so that they would not pay more than 38 percent of their gross income on housing expenses. Another option is for loans to be extended to 40 years from 30, and for some of the principal to be deferred, interest-free."

This was big news today but I consider it to be a non event. Basically all this does is help a bunch of deadbeats that got in over their head when buying a house. I hope they enjoy their new 40 year loan. The owners will be in diapers and eating food with dentures by the time they get their loan paid off.

I will just lump this proposal in with the other loan modifications that I discussed last week. I still predict millions will walk away from their homes. Who wants to live in the same house for 40 years? With all of the job losses that are coming down the pike as the recession deepens, many will be forced to walk away in order to find work. Half of Michigan will walk away if Ford or GM goes down.

Detroit will turn into a giant Flint, MI filled with empty boarded up homes.

When it comes to the market in coming weeks, focus on the technicals. We are approaching some key support levels on the downside as I described before. If we crash right through them expect all hell to break loose. However, I expect the lows to hold for now because we have just entered into the severe part of this recession, and the holidays are coming which are usually slightly helpful to equities.

We have retail numbers still to come this week, and this could be the trigger that gets us down to the 8175 level.

Lets hope the market holds here. If it doesn't we may see The Grinch steal Christmas.

And I thought I was Bearish

I will have a market update later today. Not looking good so far folks.

Monday, November 10, 2008

Fannie Fiasco

Welcome to reversal Monday. Well, the market cheered the China bailout as we shot out of the gates up 200 on the DOW this morning. The markets quickly reversed and ended up closing in the red by the end of the day.

One of the main concerns according to CNBC was what I discussed on here yesterday. If China is going to use $580 billion of their reserves on a huge financial stimulus, how are they going to buy treasuries? There was a lot of banter and debate among the pigmen on how this all plays out.

We will learn a lot about China's post stimulus demand for treasuries this week. There are 3 massive treasury auctions this week. Keep a close eye on these folks. These auctions could be market movers if they don't go well. Watch the bond market.

Fannie Fiasco

This was another huge market mover today folks. The housing market continues to disintegrate. Fannie's earnings were a complete disaster. In fact, they were flat out gruesome! Here is article one on Earnings:

"Nov. 10 (Bloomberg) -- Fannie Mae posted a record quarterly loss as new Chief Executive Officer Herbert Allison slashed the value of the mortgage-finance provider's assets by at least $21.4 billion and said it may need to tap federal funds next year.

In its first report since being seized by the U.S. government in September, Washington-based Fannie said its third- quarter net loss widened to $29 billion, or $13 a share, the largest for any U.S. company this year.

Allison, the former head of TIAA-CREF who was hired when the government took over Fannie and Freddie Mac, reduced most of Fannie's deferred tax credits, increased default estimates and raised credit loss estimates. The decisions cut Fannie's net worth by 79 percent and shows the new management is taking a dimmer view of the company's financial future than the team under former CEO Daniel Mudd.

``The earnings were gruesome,'' said Howard Shapiro, an analyst at Fox-Pitt Kelton Inc. in New York. ``They're trying to clean house.''

Article Two On the the Treasury's Fannie Dilemma:

"Nov. 10 (Bloomberg) -- Fannie Mae may need more than the $100 billion in funding pledged by the U.S. Treasury to stay afloat after reporting a record $29 billion loss and confronting more difficulty in issuing and refinancing debt.

``This commitment may not be sufficient to keep us in solvent condition or from being placed into receivership,'' if there are further ``substantial'' losses or if the company is unable to sell unsecured debt, Washington-based Fannie said in a filing today with the U.S. Securities and Exchange Commission.

Fannie said it has a limited ability to issue debt maturing past one year, citing market conditions, the lack of an explicit federal guarantee and competition from government-insured bank bonds. Fannie, which along with Freddie Mac was seized by regulators on Sept. 6, slashed the value of its assets by at least $21.4 billion for the third quarter and increased credit loss reserves by 75 percent to $15.6 billion. Freddie is required to file its quarterly earnings by the end of the week.

``Treasury may end up putting far more than $100 billion into these entities, especially if the housing market continues to decline,'' said Rajiv Setia, a fixed-income analyst at Barclays Capital in New York. ``There's just no way, no way'' Fannie and Freddie will emerge from conservatorship within the next two to three years, he said."

My Take:

What a fiasco. A $29 billion dollar loss in one quarter! It takes GM almost a full year to lose that much money! The Fed has a better chance of seeing god than getting out of this mess for $100 billion. I hope some of you picked up some SRS. It was up $24 today as it becomes more and more evident that the commercial and housing markets are completely blowing up.

God only knows how much this is going to cost us when its all said and done. As I have been saying for the past couple of weeks, the TARP is nowhere near big enough to get us out of this financial crisis. Fannie alone is going to burn through over $120 billion this year as the housing time bomb blows up.

The TARP is like using a BB gun to shoot an elephant in this situation. It can't bailout America. This problem is way bigger than the government, and the reality of this is becoming more and more apparent everyday.

AIG

AIG also was in the news today and gives us more evidence of how in over our heads in terms having the $$$ to stop this financial tsunami. This bailout originally started at $85 billion. As you can see, this problem has grown out of control just like the Fannie fiasco. Take a look at the news from the WSJ on the new AIG bailout:

"U.S. Throws New Lifeline to AIG,

Scrapping Original Rescue Deal

By MATTHEW KARNITSCHNIG, LIAM PLEVEN and SERENA NG

The U.S. government reached a deal Sunday night to scrap its original $123 billion bailout of American International Group Inc. and replace it with a new $150 billion package, according to people familiar with the matter."

Ooops...I guess AIG's problems are way worse than anticipated. This bailout is now costing us almost double what we expected. How many "lifelines" is this country willing to extend? Last I saw on "Who wants to be a Millionaire?" you only get one lifeline. Maybe the government needs to watch Regis and follow suit.

A little math lesson here folks: These two companies alone are going to cost the taxpayers $270 billion. How in the hell is the TARP going to save us all when Fannie and AIG alone are going to cost us an equivalent of more than 1/3 TARP's $700 billion total price tag? I hope they are kidding.

Bottom Line:

The bailouts need to stop or we are going to end up living in Hoovervilles again. You know what happens next here folks. Paulson will once again come into DC with hat in hand asking for another housing bailout package from Congress. The TARP will be emptier than Lehman Bros. savings account within a matter of weeks.

Folks, Paulson must be stopped if he comes asking for more. I mean where will this all end? Do you realize how long its going to take to pay back these debts? Its going to take generations if this crap doesn't stop.

Companies need to be allowed to fail. We cannot afford to keep doing this! We will default on ourselves if the government tries to save us all.

The massive debts incurred by Wall St and the people of this nation need to be defaulted on versus being sucked on to the Treasury's balance sheet at the expense of the taxpayers. We need to march into Washington with torches and pitchforks if they attempt to suck another $700 billion out of us!

Trading

From a trading perspective. I held onto my SRS and my other shorts despite the jump today. I plan on dumping SRS tomorrow if we see another leg down. DIG is starting to look compelling if oil gets into the 50's. So far the 60 level appears to be holding so I will wait. I also held onto my GDX calls. No new positions here. Waiting for better entries.

Lets hope the bailouts stop soon folks.

China may not be there to finance our debts any longer. We are running out of $$$ and time.

Be prepared for The Great Depression Part 2 if this insanity continues.

Sunday, November 9, 2008

The Silence is Deafening

I don't know if this is good or bad. I think we are heading into a wait and see period as the world hopes and prays the bailouts will save the world economies from collapsing.

I think the market will start to trade more off of fundamentals going forward. The interventions/bailouts have been so massive that any new bailouts will be considered mostly irrelevant at this point.

The automotive bailout is about the only thing I see as being a big market mover in the near term. China announced a $580 billion economic stimulus today in an effort to stimulate their rapidly slowing economy. China will feel our pain as our consumers stop consuming. We all know how dependant their factories are on us continuing to spend ourselves into oblivion. Those days are gone as the credit in the USA disappears at lightning speed while we deleverage ourselves. This is going to cripple China's growth.

It will be interesting to see how the market digests this tomorrow. The China growth story obviously appears to be over. My question here is will they still continue to buy treasuries as their growth slows and more money is needed at home? It will be interesting going forward to see how successful the massive treasury sales are as the Fed tries to fund itself after bailing out America.

I mean lets think about this for a second. China, Russia, and the middle east are all critical buyers of our debt. All three are in deep trouble financially as the world recession deepens. China is turning into a disaster as described above, and Russia and the middle east are almost totally dependent on oil. The pullback in oil prices from $147 down to $60 has been crippling for Russia and the middle east. Russia's stock market has virtually disappeared in a matter of months.

I don't see how any of these three will continue to buy treasuries at the same pace they have in the last several years. The scary thing here is their likely pullback is going to come at a time when our government needs them the most.

The Fed has $2 trillion on its balance sheet that it needs to pay for. If the world backs away from our debt, its "lights out" for our economy in my opinion.

Essentially what has happened over the past couple months is the Fed/Treasury has become a highly leveraged hedge fund that is replacing the 40-1 leverage that's been yanked away from the banking system. This is doomed to fail just like anyone else that overleveraged themselves. The failure of the investment banks and Fannie/Freddie have already proved that this doesn't work!

When this occurs is any ones guess but rest assured this idea will fail. When it does, treasury demand will disappear until we approach this the right way by digging ourselves out of debt and letting insolvent companies fail.