Saturday, May 16, 2009

America Needs to Wake the Hell Up!

I read this article today and it made me blow a gasket:

"75% in survey think worst is over in housing slump

Three out of four U.S. homeowners think the worst is over in the housing market.

The National Association of Realtors reported earlier this week that median home sales prices across the country were down almost 14 percent in the first quarter from a year ago.

"While homeowners are now more realistic when looking backward, they are still pretty starry-eyed when looking forward, with three out of four homeowners believing that their own homes' prices will increase or be flat over the next six months," Dr. Stan Humphries, Zillow's vice president of data and analytics, said in the report. "Unfortunately, there are few markets we expect to perform this well."

Thousands of potential sellers are waiting on the sidelines, Zillow said.

More than 30 percent of homeowners said they would be likely to put their houses up for sale at the first sign of a market rebound. That's bad news for prices.

"With almost a third of homeowners poised to jump into the market at the first sign of stabilization, this could create a steady stream of new inventory adding to already record-high inventory levels, thus keeping downward pressure on home prices," Humphries said."

My Take:

I don't know how else to say this so please forgive me for being so crude:

AMERICA: GET YOUR HEAD OUT OF YOUR ASS! THE HOUSING MARKET IS TOAST!

Housing prices are not stabilizing. Sitting on the sidelines and waiting for the market to come back is FINANCIAL SUICIDE!

How many investors held tech stocks at the peak of the tech boom thinking they would come back after the NASDAQ dropped from 5000-3000. How did that work out? Ummm...Not very well considering 10 years later the NASDAQ currently sits at 1680.

Sitting on the sidelines will only guarantee that you end up losing more money because housing is in the midst of reverting to the mean as it recover from an unprecedented housing bubble.

Why will housing continue to collapse?

Its simple:

The fraudulent lending products used to inflate the bubble like subprime are no longer available. This means buyers must conform to old shool lending standards which are much tougher. Interest rates will only RISE going forward because the Fed will eventually be forced to raise rates in order to fight the inevitable massive inflation as a result of printing trillions of dollars of bailout money.

How much is that $500,000 house going to be worth when interest rates go from 5% to 10%? Let me answer that for you: Around $250,000 of LESS.

On top of the issues above, the foreclosure moratorium is now over. As a result, there will be thousands and thousands of new foreclosures hitting the market. This will only put further pressure on housing prices.

Soaring unemployment only adds to to the housing nightmare. One only needs to take a look at Detroit in oreder to see how massive job losses effect home prices. The average price for a home is $30,000 in the city of Detroit. Gee, do you think a 12% unemployment rate in the state due to the collapsing auto industry could have something to do with that?

Now is the absolute worst time that you could buy a house. Realtors will tell you: Interest rates are at an all time low! Now is the time to buy! The problem is realtors don't understand the economy. This sales pitch made sense when interest rates were low at a time when our deficits were also close to zero as they were in the late '90's.

The problem today is we are $11 trillion in DEBT. Money is going to get very expensive moving forward because our debtload is at record highs! Mortgage rates are based on what the yields are on the 10-year in the bond market. The 10-year stays low as long as our deficits are reasonable.

The 10-year rises at times when our country is in debt because the country needs to increase yields in order to make our 10-year bonds more attractive. The reason they need to increase the yields on the 10-year is because debt investors are concerned about the risk of default as a result of America carrying too much debt. If America goes bust, they don't get made whole on the bonds that they bought!

As a result, we are pretty much screwed in this department because WE ARE TRILLIONS OF DOLLARS IN THE HOLE! YIELDS WILL INEVITABLY SOAR DUE TO OUR EXPLODING SPENDING AND DEFICITS!

Bottom Line:

Buying a house right now is financial suicde unless you plan on living there for 30 years until the house is paid off. You will NEVER IMO be able to sell your house for a higher price if you buy today unless you are buying at the lower end of the housing market ie: 200k or less.

The home owners that are waiting for housing to stabilize will be in their 70's before they sell because this isn't happening anytime soon. Again, let me bring this back to the tech bubble. Amazon's stock once hit over $400 on the NASDAQ. Today it sits at $73 dollars and its been one of the best performers on the NASDAQ over the past few years.

When bubbles burst they never come back. EVER!

Don't be a fool. If you rent don't buy because the rates are too artificially low. If you are selling drop your price aggresively before the thousands of foreclosures come on to the market. The housing market is only going to get uglier and tougher moving forward. Inventories are only going to rise. Sell and get the hell out!

The only houses that I would consider buying are houses in the $200k and under market. The low end of the market is selling because buyers are able to qualify to buy. Prices seem to be holding up reasonably well here for now. The problem is as unemployment continues to rise, I worry that even this end of the market may fold like a tent down the road.

Stay on the sidelines! Prices will be deflating for years.

Friday, May 15, 2009

A Shift in Sentiment

So what are investors afraid of? Oh my, Where do you begin?....Lets let Howard Davidowitz, chairman of Davidowitz & Associates explain why:

"The debt doesn't go away!":

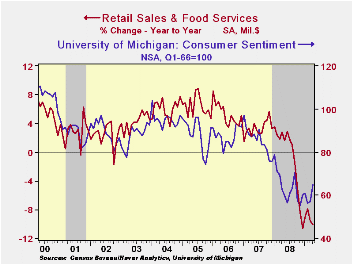

I really don't have much to add here. I have been preaching the same thing on here for over a year now. The consumer will never reach the heights that it did in the early 2000's. The housing ATM is gone, and its time to pay the bill.

More "green shoots"

Since the consumer has been replaced by the governments balance sheet in the form of bailouts, one might expect to see corporate earnings swirl right down the toilet. I mean after all, the government isn't fueling any growth in the economy with their spending binge.

The're too busy using it to bailout their corrupt banking buddies. If they aren't throwing money at Wall St, they are throwing it into every company that has failed. Chrysler/GM ring a bell?

Regardless of who gets it, the money is not ending up in the real economy. The handouts usually just evaporate as they are used to mop up massive debts on corporate balance sheets. If the money isn't being used to mop up debt, its hoarded by the banks as they attempt to survive the oncoming depression that they all know is heading right towards us.

If the banks aren't hoarding the cash, they are sending it to their trading desks where it's used to manipulate our corrupt stock market. After they rake in a nice trading profit at our expense, it goes right back in the safe never to be seen again.

You didn't think they were actually going to lend that money to us did you? HA! The bankers are laughing all the way too the bank(no pun intended) after stealing $700 billion in TARP funds from the taxpayer..

Since none of the government stimulus is getting into the real economy, corporate earnings are COLLAPSING.

Sit down before you take a look at S&P earnings chart below:

Stunning isn't it? I thought those assclowns on CNBC said that stocks were cheap? HA! Your kidding me right?

Folks, I am not exaggerating when I tell you the economy is being destroyed right before our very eyes. All you need to do is look at the numbers. The real economy is crashing because the government stimulus is being thrown at the bankers and other corporate oligarch's instead of "we the people".

You think its bad now? You haven't seen anything yet.

A few questions for the powers that be:

Why didn't the Fed take their trillions of dollars and use it to create jobs versus bailing out crooks? Why didn't they at least use it to shore up social programs that are going to be desperately needed when this debt bubble collapses?

WHY IS THE MONEY BEING THROWN TO THE WALL ST THIEVES?

WHY ARE WE WASTING THE REST OF THE MONEY ON COMPANIES THAT DESERVE TO FAIL?

Remember the good ol' days where companies that failed went out of business? History has shown us that it's wasn't the end of the world when a bank or a company failed. Wall St would like for you to think that. They want you believe that if they fail the economy collapses and we all go down with it.

Funny, I don't ever recall seeing this happen before. We survived The Great Depression when thousands of banks failed. Guess what? New banks with healthy balance sheets would most assuredly take their place. This is how capitalism works!. The reality here is this is nothing but a mirage that Wall St has created in order to save their own asses via government bailouts.

The same goes for non financial companies that have failed. Has everyone all of the sudden forgotten that new companies can arise from the ashes of failures that have actually have a chance to make a profit? Perhaps if GM failed a smaller stronger car company would replace it that actually has a chance to grow and create new jobs! If AIG failed I am sure there are plenty of other insurance companies that could replace AIG.

I mean Christ: We have thrown $170 BILLION into AIG and what in the hell do we have to show for it? NOTHING! If they failed tomorrow are we all going to die? Doubt it.

That's it for me today folks. Its time to throw back a few beers and escape reality.

Depressions are much easier to tolerate after a few cocktails.

Until tomorrow!

Thursday, May 14, 2009

Green Shoots! ....In 2016

Mr. Prechter believes that we will see a deflationary economic collapse similar to what we saw during the 1929-1932 period of The Great Depression. According to his models, the S&P will bottom at around half of the March lows. That's 333 on the S&P folks! Let me note that Robert Prechter is no slouch. He is widely known and very respected. He became well known for predicting the 1987 crash.

Robert also predicts that this collapse will last through 2016. Here are a few quotes and a link to the piece.

" NEW YORK (Reuters) - Longtime technical analyst Robert Prechter, who forecast the 1987 stock market crash, predicted this week that U.S. equities may plunge to half their lows hit in March as a deflationary depression bites.

Oil and U.S. Treasury bonds are also locked in long term bear markets, while corporate bond prices will plunge precipitously by next year as broad economy, banking system and company earnings sustain more damage from a financial crisis that's akin to the Great Depression, he said.

The U.S. S&P 500 stock index's .SPX rebound by nearly 40 percent since it sagged to a 12-year closing low of 676 points on March 9 is not sustainable, Prechter said in an interview with Reuters.

"It's not the start of a new bull market," said Prechter, chief executive at research company Elliott Wave International in Gainesville, Georgia. "Our models are (showing) right now that it is a much bigger bear market than most people realize, something along the lines of 1929-1932," he told Reuters in a wide ranging interview. "It's a very rare event," he added.

"I think the next leg down will be at least as severe if not more severe than what we just experienced. So you want to stay on the side of safety," he said.

As in his 2002 book "Conquer the Crash," which warned of the dangers of a U.S. debt bubble and deflationary depression, Prechter continues to advocate safer cash proxies such as Treasury bills.

SEVEN MORE YEARS?

Riskier assets such as commodities, corporate bonds, and stocks which are currently anticipating that the severe global economic downturn may be bottoming, are likely to have short lived intense rallies, but within an inexorable long-term decline that may last another seven years, he said.

As banks continue to accumulate losses and corporate earnings fall, "the difficulties will probably last through about 2016," he said. "There will be plenty of rallies along the way."

"Deflation is coming, it's going to lead to a depression. We're not at the bottom yet," Prechter said. "I think we are going to have bouts of deflation separated by recoveries."

Prechter also painted a bleak picture for commodities like silver and is largely unenthusiastic about gold, believing the precious metal made a major peak when it rose above $1,000 last year.

The benchmark U.S. 10-year Treasury note yield, which moves inversely to its price, hit a five-decade low of 2.04 percent in mid-December.

"People got very enamored with bonds and very enamored with gold and I don't like to be invested in markets that are over subscribed," Prechter said.

"The Treasury (Department) has taken on so much bad debt" at a time tax receipts are falling, that "there will be a slow, but very steady change in the way people will view the U.S. government," said Prechter. As a result, investors in Treasury notes and bonds will ultimately demand higher yields, he said.

The U.S. central bank will not be able to control the government bond market and prevent yields from rising, regardless of how much money the Fed uses to buy Treasuries, he added."

Quick Take:

Yikes! And I thought I was bearish. Robert makes me sound like a bull! If the S&P gets to 333 the S&P 500 will have to be renamed the S&P 250 because half of the companies that compose it will go under.

Not much else to say here. I see the exact same thing unfolding. Note that he did pooh pooh gold which I thought was interesting. However, any true deflationist usually does because they believe no one will have the money to afford it which results in plummeting demand and much lower prices.

I still believe hedging yourself with some gold is a smart move. As I said yesterday, owning gold is not an investment. Its for your own protection in case the US dollar collapses.

Got Jobs?

Initial jobless claims ticked back up after dropping last week:Ah yes....Add this to the other tumbleweeds that continue to flatten our economy. The uptick in initial claims tell you that companies are once again laying off at a higher rate. This pretty much blows up the green shoot theory that the economy is recovering. Initial claims should be dropping not rising in the green shoots scenario.

Wait until the GM and Chrysler layoffs hit. Chrysler dumped 3000 dealerships today. Anyone employed at these dealers will immediately be furloughed. Imagine what the claims number will look like once this reality hits.

Obama: Our Debt Load is Unsustainable

Gee really? Thanks for telling me...I hadn't really noticed.(scarcasm off)

Little question here Obama: Why are you spending $3.6 trillion this year if this is the case? Why are you allowing the Fed to expand its balance sheet to $2 trillion that we don't have. Why is our budget deficit now $1.8 trillion and growing by the day?

Put your money where your mouth is and stop spending! Perhaps then I will pay attention to this mindless babble. Anyone else beginning to think this guy is all bark and no bite? He reminds you of that guy who says all the right things but does nothing. Change we can believe in! Not! Sounds like just another politician to me.

Bottom Line:

Prechter is right on in my opinion. 2016 sure seems like a long ways away doesn't it? Ouch!

I think we will continue to see short term volatility in the markets as Ben throws the kitchen sink at deflation.

Stock prices will be difficult to gauge while Ben fights inflation because he is flooding the system with money. Stocks will move higher as a result at times because this money all needs to go somewhere. Some of it will assuredly end up in equities. The counterbalance to stocks moving higher is the obvious fact that the economy totally sucks! This will cause violent moves to the downside at times.

Longer term stocks will eventually collapse because inflation will begin to cripple the consumer as a result of higher prices. At this point Ben must pull his liquidity because he risks killing the consumer's purchasing power and thus the economy. This is the point at which you will see equities crash.

Until then stay nimble and don't marry your positions. I actually made a few small trades today. I bought some longer dated Sept. SPY PUTS and some long dated calls on GLD. I think the dollar will continue to slide in the near term which will push gold higher. I picked up the SPY's because things look very toppy to me here.

Until tomorrow!

Wednesday, May 13, 2009

Are Those Green Shoots or Tumbleweeds?

It appears those green sheets are looking a little brown after today's nasty sell off in the stock market. All of the major indices closed down sharply. The VIX was up and surprisingly so was the dollar. Commodities took a beating as a result.

It appears the rally is beginning to lose a lot of its steam. The NASDAQ has now been down for three days in a row. The financials have also continued to pullback as traders begin to price in the dilution of the banks's stocks prices following a string of capital raising announcements by several of the large banks via new stock offerings.

The banking stocks are selling off because there is a lot of fear around the demand for these stock offerings due to the massive amounts of shares that need to be sold. Everyone and their uncle on Wall St is trying to raise capital now after watching their stock prices double or even triple in the last 8 weeks.

So traders are wondering how this all plays out. Will the financials be forced to sell shares at lower prices due to excess demand which then results in even further dilution? My guess here is of course. The banks have repeatedly burned investors via capital raising's over the last 3 years. This has made private equity extremely gun shy. When was the last time you heard about a SWF investing in Wall St?

Retail Sales Disappoint

This is what really got things headed to the downside today:

Here is the scoop from Bloomberg:

"May 13 (Bloomberg) -- Retail sales in the U.S. unexpectedly dropped in April for a second month, indicating that rising unemployment is prompting consumers to conserve cash.

The 0.4 percent decrease followed a revised 1.3 percent drop in March that was larger than previously estimated, the Commerce Department said today in Washington. Other reports showed companies continued to cut stockpiles as demand slowed, and climbing oil costs pushed up prices for imported goods.

Fewer jobs, falling home values and the biggest loss of household wealth on record may limit consumers’ ability to spend for years, analysts said. Stocks dropped for a third day as the reports indicated any recovery from the worst recession in at least half a century is likely to be subdued."

My Take:

So much for the consumer turning the corner. The obsessive bullishness on Wall St never ceases to amaze me. Why on earth were they not expecting the consumer to continue to contract? Housing wealth is evaporating. Unemployment is at a 26 year high and looks to be on a collision course to reach 10% within a matter of a couple months. Despite this obvious reality, the bulls have been on CNBC screaming about the comeback of the US consumer. Dream on boys!

The "bubblehead" analysts and economists need to wake the hell up and realize that the consumer is going to be worthless for years if not a decade or more. Its time that all of them go back to school and study The Great Depression because this is the type of scenario that they need to build into the models that they use to create earnings estimates.

A Real Green Shoot?

I have been screaming for transparency on here for over a year now. It appears we took a step in the right direction today with Geithner's announcement around increasing the transparency in the over the counter derivatives market:

"May 13 (Bloomberg) -- Treasury Secretary Timothy Geithner urged banks to increase transparency in the over-the-counter derivatives market by making prices available on centralized computer platforms.

Increased regulation is needed to reduce risk to the financial system, Geithner said today in a news conference in Washington. He laid out a framework in March for more policing of financial markets as the worst credit crisis since the Great Depression caused more than $1.4 trillion in writedowns by banks and financial companies worldwide.

The OTC derivatives markets must be moved “onto regulated exchanges and regulated transparent electronic trade execution systems,” Geithner said today in a letter to Senator Harry Reid, the Democratic Majority Leader from Nevada.

Electronic execution of trades including interest-rate and credit-default swaps would allow users of the financial instruments to get greater price transparency and make processing trades easier. Transactions in the $684 trillion over-the-counter derivatives market are now typically conducted over the phone between banks and customers.

Geithner’s position highlights a shift in Washington toward more market regulation."

Quick Take:

A hat tip to Mr. Geithner on this one. Could this be a warning shot across the bow from Washington to Wall St around transparency? I hope so. The derivatives game was a flat out scam. Executing these trades using a computer trading platform creates total transparency and instills confidence into the financial system.

This is not good news for the banks by the way. This was a very profitable gig. Its not like I feel sorry for them. They gamed the system and they are now forced to pay the consequences for it.

Bottom Line:

Today could be a turning point for the markets. We will need to see some follow through but the bear market rally may very well be over. The question now becomes this: Is this a 10-15% correction before heading to new highs or do we visit Lucifer and drop like a rock back down to the lows.

Time will tell. The manipulation of the markets is still in high gear so I wouldn't be getting too aggressive here. If you ask me the price action has been very erratic lately. I feel very little conviction either way short term.

My views have not changed for the longer term. Its "game over" perhaps by the end of the year. The timing of this is of course is impossible.

Watch the dollar, the treasury markets, and the stock offerings over the next few weeks. Also, take note that the reflation trade was stopped dead in its tracks today. Is the deflation trade back on now that the street realizes that the consumer is still lying flat on his back gasping for air?

I am leaning towards saying yes but I need to see more follow through.

Until tomorrow!

Tuesday, May 12, 2009

Deflationary Destruction of The US Dollar?

Unfortunately, as this crisis unfolds, I believe the measures discussed below should now be considered to be prudent.

I want to survive this financial catastrophe, and I am constantly looking for different solutions that will ensure my survival.

Ok, lets get to it:

As I sit here and watch the US dollar drop on an almost daily basis(btw the way we hit our lowest levels today since Jan.), I have begun to search for alternatives by which I can protect the wealth that I have accumulated. Many believe that inflation or hyper-inflation will destroy the US dollar. Whats proposed below is the exact opposite. Some believe that it will actually be DEFLATION that eventually takes down the dollar.

I read a brilliant interview today in The Daily Bell of Dr. Antal Fekete who is an esteemed author, mathematician, monetary scientist and educator. His insights in this interview were absolutely brilliant in my opinion. This is a long read but well worth it in my view so please take some time to read it.

Dr. Fekete's thesis is very different from your basic Keynesian economist. Any of you that have read me for awhile know that I love thinking thats "outside the box". There are many great thoughts in this interview around monetary policy and why the Fed's monetary approach will eventually result in an epic failure.

I wanted to focus on just a few points here that are most relevant to all of us. Let me highlight a few excerpts from Dr. Fekete and then I will then post some thoughts below:

"Dr. Fekete on why deflation not hyper-inflation will destroy the dollar:

"Daily Bell: Can the current paper money system stand, or is it on its last legs?

Prof. Fekete: Since the eruption of the financial and economic crisis in 2007 we may take it for granted that the regime of irredeemable paper money is on its last legs. However, it may take several more years of agony, because of the colossal ignorance of people concerning money. For example, most people with a better than average grasp of the theory of money expect that the dollar will succumb to hyperinflation. They will be disappointed. The dollar will put up a tough fight and in the end it will self-destruct, not through inflation but through deflation.

Daily Bell: Can you expand on this issue? What makes you suggest that hyper-inflation is not in the cards?

Prof. Fekete: Producers will, of course, try to raise prices as the dollar is weakening further. However, people are not in the mood to spend. If they come into possession of money, they will use it to repay their debts. They have no savings to fall back on in case they lose their jobs. In the absence of buying, price increases will have to be rescinded (as they have been in the case of crude oil, for example) causing many a producer to go bankrupt.

There is a new factor that plays an important role, not present in previous episodes: the parallel existence of electronic dollars and Federal Reserve notes. Only a small portion, less than ten percent, is in the form of the latter; the rest is electronic money. People at home and abroad hoard only dollars that they can fold. It is physically impossible to print them fast enough to replace electronic dollars that the people, firms, institutions and foreign governments may decide to reject. The velocity of circulation of paper dollars is falling to zero while that of electronic dollars is rising beyond any limit. This splitting of the money supply into two components of divergent velocities spells deflation. The component with increasing velocity will have to be written off. The Fed is helpless as the hoarding of its notes assumes unheard of proportions.

Daily Bell: Can the Fed really sterilize the monetary system as Ben Bernanke and others contend?

Prof. Fekete: If by "sterilization" you mean isolating the exploding money supply from exploding prices, my answer is that Bernanke does not want to do that. In fact he is desperately but unsuccessfully trying to induce a rise in the price level, even at the risk of a price explosion. But to no avail: all the new electronic money he is creating goes into debt liquidation and speculation on the long side of the bond market. None of it goes to bid up commodity prices, or the prices of industrial shares, or the price of real estate.

There is a vicious spiral: the more money Bernanke creates, the more rampant bond speculation becomes, the higher bond prices go, the lower interest rates fall, the lower price-level falls, prompting more money-creation by Bernanke, etc.

Why do falling interest rates necessarily induce lower prices? Now here is the rub: because falling interest rates destroy capital through increasing the liquidation value of debt. I have a whole new theory on that: The Revisionist Theory of Depressions. My main thesis is that a falling interest-rate structure increases the burden of debt (just the opposite that you would intuitively expect!) thereby causing producers to go bankrupt in droves. You can read this special report, now available at the Daily Bell, click here."

Dr. Fekete on the gold's transformation from contango to backwardation:

Daily Bell: Is there any evidence that hoarders of gold and silver behave as you suggest, and not as common sense would dictate? After all, it is a universal feature of the commodity markets that the longs take profits periodically as prices keep rising.

Prof. Fekete: Yes, indeed, there is: the behavior of the gold basis. Basis is the difference between the nearby futures price and the spot price. Contango is the name for the condition whereby the basis is positive; while backwardation indicates a negative basis: higher spot price and lower futures price. Whenever supplies are adequate, contango obtains and the basis indicates what the carrying charges are such as interest, cost of storage and insurance. Backwardation always and everywhere indicates a shortage of the physical metal. Therefore, normally, gold should never be in backwardation, i.e., the futures price should always be higher than the spot price. The basis may be substituted by a spread, i.e., the difference between the price of a distant and a nearby futures contract.

Right now, the gold basis is at a critical inflection point, suggesting that gold may plunge from permanent contango to permanent backwardation for the first time ever. On April 21 Dan Norcini published charts showing the dramatic collapse of the April 09/June 09 and of the April 09/Dec 09 gold spreads at the Comex. The former went from $6.50 at one point to tiny_mce_marker.60 now. The charts indicate that gold is on its way to backwardation later this year. Backwardation in gold is an extremely rare phenomenon with the most serious implications. It shows that supplies of physical gold are drying up as hoarders and the mines are increasingly withdrawing their offer to sell. It is like a chain reaction, at the end of which gold is not for sale at any price.

Dr. Fekete on protecting yourself:

"Daily Bell: What can people do to protect themselves at this time?

Prof. Fekete: Other than praying and hoping, they could get out of debt and keep accumulating gold and silver coins, buying on every weakness in the price. They could also hoard Federal Reserve notes and the notes of the Swiss National Bank of small denominations, in amounts corresponding to their needs for up to two years. To keep money on deposit in a bank is not advisable under any circumstances. And, let's not forget, they should cash in on their life insurance policies."

My Take:

Very interesting isn't it? I think its pretty hard core but brilliant.

Basically there are a few take home points here:

1. Raising cash in this crazy world no longer means holding money in a bank account or treasuries. Raising cash means holding FRN's( Federal Reserve Notes). In other words: Cold Hard Cash! Look at the top of a dollar in your pocket and see what it reads: Federal Reserve Note! As you can see above, the bailouts are being done in the form of electronic money. Less than 10% is printed in the form of FRN's. FRN's are a great thing to have because they offer a zero interest coupon that has indefinite maturity. I have begun accumulating FRN's over the last several weeks.

There could very well come a time where the world will no longer accept our debt after watching the Fed create trillions of "digital dollars". These "digital dollars" could become worthless down the road if the world begins to decouple from the US dollar and begins to no longer accept it as payment. FRN's have a much better chance of holding value because they make up less than 10% of our money supply.

Think about it. What would you rather own?: FRN's which account for less then 10% of the money supply or one of the trillions of "digital dollars". Thats an easy answer if you ask me.

The problem here is you need a safe place to store it. A properly installed safe is a great place to hold FRN's.

2. Buy some gold and silver coins. Let me emphasize: COINS. Coins are preferred because they are much more easily used as a form of money. I would focus my purchases more on the silver side versus gold. Silver is less expensive and would give you more flexability in terms of using it as a currency.

3. Pray that it never comes to this! However, I am afraid we are now approaching the time in which we all need to begin preparing ourselves for the worst because I believe their is no solution to the mess we have dug ourselves into.

The fact that we are about to see a backwardation in gold is very ominous folks. This means that no one wants to sell and nations like China are buying any gold they can get their hands on. My take on gold here is people are not buying it as an investment. They are buying and hoarding it because they believe that we may see the US dollar self destruct. This is protection versus speculation.

Now let me reiterate that I have never been a big gold fan. I also don't believe we are going to see a "Mad Max" scenario. I will continue to keep the majority of my portfolio in FDIC insured accounts and treasuries.

However, I will begin to rapidly increase my FRN holdings. I will also begin accumulating some silver and gold coins. My first choice of the three options above is FRN's. If the crap hits the fan I believe physical cash will still be usable. It may have to be converted into some other form of currency but it will hold its value nonetheless.

As for the stock market, the more I watch it the more I believe its just the tail of some large dog that's manipulating the crap out of it. Exactly who is this dog? The government? The bond market? The trading desks on Wall St? Perhaps its a combination of all of the above? Who knows, my guess is its a little of all three.

What is becoming increasingly clear is our problems now run far beyond our issues in the stock market. Our way of life is crumbling as the oligarch's power over the people continues to increase.

Socialism looms right around the corner if our country continues down the same path.

In fact, if the government doesn't wise up and change its ways, they run the risk of losing power. Germany's economic collapse was the key driver that allowed Hitler and facsism to rise to power. No government has ever survived following a hyperinflation/economic collapse. The freedoms that our founding fathers worked so hard for are slowly falling apart as this crisis begins to unravel.

Don't think it can happen here? Ask a Chrysler bondholder how they feel about their freedoms after being strong armed by the government to sell their bonds at .10 on the dollar. Bondholders NEVER roll over and accept .10 on the dollar without going to BK court. You can bet that they were threatened with their lives if they didn't accept this deal.

Is this how a free capitalistic country works? Don't think so. In fact, it sounds more like an episode of The Soprano's.

Monday, May 11, 2009

My Dream Girl: Meredith Whitney

Lots to get to today so lets "get it on" like they say in the UFC.

Let me start out with some "bear porn" from Meredith Whitney. In my opinion, this is the best analyst on Wall St. I had to laugh watching this interview because stocks took about a 50 point nosedive by the time she had finished her interview. Her insights are brilliant as usual. This is a must watch.

She kinda stole my thunder a little bit today because I had planned on discussing some shorts on the consumer retail ETF's. I think this is the best short out there. What has me a little worried here is everyone and their mother is going to hop into this trade now that Meredith has hit the airwaves with the same thoughts.

In this traders market, you need to be very leery of being involved(long or short) in trades that everyone else has piled into. Especially when you see lighter trading volumes like we saw today.

The reason I say this is because the markets can be manipulated by the big trading desks like Goldman Sachs. If the big boys get the market moving higher with huge buy orders, shorts that are heavily piled in to tend to get slaughtered even if fundamentally the trade is a good one. This is a result of massive short covering by the bears.

This short covering phenomenon has become even more exacurbated in today's market because the shorts have gotten their teeth kicked in over the past 8 weeks. This has given the bears a bad case of PTSD which of course makes them much more susecptible to covering much earlier then they have in the past.

Anyway, enjoy and I will continue below after you listen to the Goddess of Wall St:

The Bullish Case?

I didn't get a chance to discuss this yesterday. There are many(including myself) that have been surprised and confused by this violent move to the upside.

There are a few opinions and theories around why the market has moved higher. Russell Napier who is the author of "anatomy of a bear" had an interesting take. Russell's main thesis is bear market rallies are common and are usually stopped dead in their tracks when treasury yields in the bond market reach around 6%.

Once yields get to these levels, they become a compelling alternative to stocks because many investors at this point then begin to then ask themselves: Why risk my money in the stock market for an 8-10% return when I can get a guaranteed return of 6% in fixed income without the risk?

Napier warns that we have a ways to go(perhaps 2 years) until yields reach 6%(not sure I agree on this timing given the $2 trillion we need to sell this year alone).

When yields do reach 6%, he believes the S&P will then collapse and hit a bear market low of around 400.

This argument is pretty compelling. However, I believe yields will hit 6% at a much faster pace. I would say we could approach 5% by the end of the year. The Fed has pissed away almost 1/3 of their QE money in an attempt to keep yields down. They can always expand their balance sheet and spend more, but they run the risk of blowing themselves up in doing so.

One more thought around the rising market. Another theory around this latest move higher revolves around the cheapening of the US dollar. Investors as a result are increasingly getting concerned about having too much cash on hand. In order to protect themselves, they are diversifying into the market and commodities as a hedge against a potential US dollar collapse as a result of our government's irresponsible Ponzi spending.

A good example of this hedging is oil. The "black gold" should be continuing to drop in price as oil tankers sit in the Persian Gulf with nowhere to go as a result of crashing demand. Instead, oil is up 33% since its recent lows. Ahhh....Higher gas prices...More good news for our crashing consumer. NOT!

Let me finish this piece by saying I still expect equities to drop. Short term there is a high probability that we see a nice correction after this huge bounce. It may have gotten started today! The news around our budget deficit swelling to almost $2 trillion dollars was pretty horrifying to the markets. Remember the days when we panicked when the deficit reached a few hundred billion dollars? Thats chump change compared to today folks.

The IG report below also spooked traders. Santelli said the "Inspector General" you tube video was the talk of the bond market today.

Inspector General

The inspector general is responsible for auditing the Fed. It sounds like someone fell asleep on the job. The lack of knowledge surrounding how the Fed used their balance sheet by the inspector is simply horrifying here folks!!

Who in the hell is protecting us? This is OUR money that the Fed is pissing away on their gangster banking buddies. They have pissed away 9 TRILLION DOLLARS and this inspector can't answer one question as to how this money was spent. NOT ONE QUESTION!

This is Watergate times 100 as far as I am concerned. Please watch this video and then buy yourself a pitchfork and a torch. Its time to march on Washington and demand that this fraud end right here and right now! We are pissing away our future generations wealth in an attempt to bailout a bunch of thieves!!

ENOUGH!

Sunday, May 10, 2009

On a Lighter Note

Happy Mothers Day to all the moms out there!

I had to throw this Saturday Night Live "stress test" skit up tonight. I was laughing out loud after watching this.

Enjoy. Back Tomorrow.