So I am sure many of you are asking yourselves how bad this banking crisis is versus previous banking fiasco's. As you can see below, nothing comes even close to this one. The moves being made today by the government are nothing but one huge experiment. No one knows how this will play out or if it will work. We are in unprecedented times. My guess is this experiment isn't going to work and its not going to end well. We took greed to a whole new level this time. History has consistently shown us the bigger the boom the bigger the bust.

The 1930's Bond Market

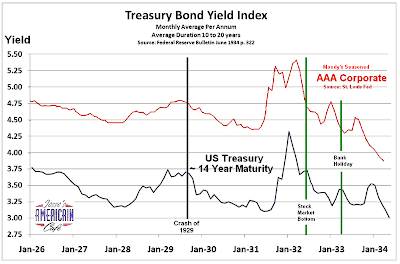

Since I discussed this yesterday, I figured it would be helpful to head back into the 1930's and see what yields did during The Great Depression:

As you can see, there was extreme volatility in terms of treasury yields throughout the 1930's. Bonds yields plummeted for about 2 years beginning in 1929 as everyone piled into treasuries seeking safety as the markets collapsed.

Notice that as we neared the bottom in the markets in 1932, yields soared resulting in higher interest rates as our debt became less attractive.

We are now nearing 2 years since this crisis began in 2007. Will we see a repeat of the 1930's in the treasury market? Time will tell but I think its extremely likely.

Remember folks, history always repeats itself.

I also wanted to also share a video that I watched on the blog Subprime Showtime over the weekend. Its about 30 minutes long but its well worth it. Its a nice history lesson on our economy and its crisis's dating back to 1835.

1 comment:

Futures getting hot hard tonight folks.

British pound is getting pummeled. The UK is in deep trouble.

Phillips warned which put severe pressure on the futures.

UK is in deep trouble as their currency literally colapses. Pound has now dropped from $2.11 per US dollar down to $1.34 in less than a year.

A UK default would not be a chocker.

Expect red tomorrow at least at the open.

Stay tuned.

Post a Comment