It appears those green sheets are looking a little brown after today's nasty sell off in the stock market. All of the major indices closed down sharply. The VIX was up and surprisingly so was the dollar. Commodities took a beating as a result.

It appears the rally is beginning to lose a lot of its steam. The NASDAQ has now been down for three days in a row. The financials have also continued to pullback as traders begin to price in the dilution of the banks's stocks prices following a string of capital raising announcements by several of the large banks via new stock offerings.

The banking stocks are selling off because there is a lot of fear around the demand for these stock offerings due to the massive amounts of shares that need to be sold. Everyone and their uncle on Wall St is trying to raise capital now after watching their stock prices double or even triple in the last 8 weeks.

So traders are wondering how this all plays out. Will the financials be forced to sell shares at lower prices due to excess demand which then results in even further dilution? My guess here is of course. The banks have repeatedly burned investors via capital raising's over the last 3 years. This has made private equity extremely gun shy. When was the last time you heard about a SWF investing in Wall St?

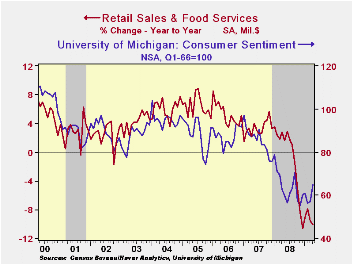

Retail Sales Disappoint

This is what really got things headed to the downside today:

Here is the scoop from Bloomberg:

"May 13 (Bloomberg) -- Retail sales in the U.S. unexpectedly dropped in April for a second month, indicating that rising unemployment is prompting consumers to conserve cash.

The 0.4 percent decrease followed a revised 1.3 percent drop in March that was larger than previously estimated, the Commerce Department said today in Washington. Other reports showed companies continued to cut stockpiles as demand slowed, and climbing oil costs pushed up prices for imported goods.

Fewer jobs, falling home values and the biggest loss of household wealth on record may limit consumers’ ability to spend for years, analysts said. Stocks dropped for a third day as the reports indicated any recovery from the worst recession in at least half a century is likely to be subdued."

My Take:

So much for the consumer turning the corner. The obsessive bullishness on Wall St never ceases to amaze me. Why on earth were they not expecting the consumer to continue to contract? Housing wealth is evaporating. Unemployment is at a 26 year high and looks to be on a collision course to reach 10% within a matter of a couple months. Despite this obvious reality, the bulls have been on CNBC screaming about the comeback of the US consumer. Dream on boys!

The "bubblehead" analysts and economists need to wake the hell up and realize that the consumer is going to be worthless for years if not a decade or more. Its time that all of them go back to school and study The Great Depression because this is the type of scenario that they need to build into the models that they use to create earnings estimates.

A Real Green Shoot?

I have been screaming for transparency on here for over a year now. It appears we took a step in the right direction today with Geithner's announcement around increasing the transparency in the over the counter derivatives market:

"May 13 (Bloomberg) -- Treasury Secretary Timothy Geithner urged banks to increase transparency in the over-the-counter derivatives market by making prices available on centralized computer platforms.

Increased regulation is needed to reduce risk to the financial system, Geithner said today in a news conference in Washington. He laid out a framework in March for more policing of financial markets as the worst credit crisis since the Great Depression caused more than $1.4 trillion in writedowns by banks and financial companies worldwide.

The OTC derivatives markets must be moved “onto regulated exchanges and regulated transparent electronic trade execution systems,” Geithner said today in a letter to Senator Harry Reid, the Democratic Majority Leader from Nevada.

Electronic execution of trades including interest-rate and credit-default swaps would allow users of the financial instruments to get greater price transparency and make processing trades easier. Transactions in the $684 trillion over-the-counter derivatives market are now typically conducted over the phone between banks and customers.

Geithner’s position highlights a shift in Washington toward more market regulation."

Quick Take:

A hat tip to Mr. Geithner on this one. Could this be a warning shot across the bow from Washington to Wall St around transparency? I hope so. The derivatives game was a flat out scam. Executing these trades using a computer trading platform creates total transparency and instills confidence into the financial system.

This is not good news for the banks by the way. This was a very profitable gig. Its not like I feel sorry for them. They gamed the system and they are now forced to pay the consequences for it.

Bottom Line:

Today could be a turning point for the markets. We will need to see some follow through but the bear market rally may very well be over. The question now becomes this: Is this a 10-15% correction before heading to new highs or do we visit Lucifer and drop like a rock back down to the lows.

Time will tell. The manipulation of the markets is still in high gear so I wouldn't be getting too aggressive here. If you ask me the price action has been very erratic lately. I feel very little conviction either way short term.

My views have not changed for the longer term. Its "game over" perhaps by the end of the year. The timing of this is of course is impossible.

Watch the dollar, the treasury markets, and the stock offerings over the next few weeks. Also, take note that the reflation trade was stopped dead in its tracks today. Is the deflation trade back on now that the street realizes that the consumer is still lying flat on his back gasping for air?

I am leaning towards saying yes but I need to see more follow through.

Until tomorrow!

12 comments:

Jeff,

According to March 7 economic data, the consumer credit is reduced by $11.1 billion.

http://biz.yahoo.com/c/ec/200919.html

The major credit card companies have been slashing credit lines, even to cardholders with good credit history.

With HELOC gone with the wind and job loss, how do they expect the consumers to spend? None of us have the luxury to print money like Uncle Ben.

It is a good thing that I never watch CNBC or any other clownvision. Otherwise I might have to shoot the TV. Enough with the BS and lies!

Anon

Clownvision..LOL First time I heard that one.

Yeah, Meredith Whitney was talking a lot about the credit card companies slashing credit lines.

I spoke to a friend of mine that sells atm's. He gets a piece of every transaction.

He said his biz is down 60% over last year as a result of nobody spending. I call him my economic indicator!

The one thing Ben has no control over is our desire to lend. that desire is now gone as a result of massive unemployment and uncertainty.

I have almost put my foot through the TV many a time watching "clownvision".

I am sick and tired of all the lies as well!

ooops typo...Desire to borrow above not lend!

Hey Jeff,

Absolutely love your site, it is one of the few i read religiously. quick question re: gold. you have been pounding the table and i agree, though i am quite reticent to buy here near the top. however, for reference, from what source(s) would you recommend buying gold and silver coins? i see these commercials all the time for "US gov't-issued gold coins..." but am very skeptical of those types. thanks for any suggestions. RG, NYC

RG

Thanks for the kind words.

I think I know the exact commercial you are talking about. Are you referencing the one seen a lot on bubblevision with the phones constantly ringing in the background?

You ask a great question.

Too be honest my table pounding on gold is only a few weeks old. The "deflationist" in me keeps telling me gold prices could collapse so I understand your hesitancy.

I am in the process of researching this very topic so I don't want to jump the gun and give advice around gold dealers before I really have a good feel for this market.

There is a lot of slime among some of these dealers and I am checking with my contacts to find out who the good guys are.

In the meantime you can buy the ETF GLD. This is what I have done in the short term.

I will let you know what I find out.

GL

J

Jeff,

Found your website from one of my favorite blog "Of Two Minds". I can tell this site will be added to the daily must reads. Keep up the good work.

Cheers

BAM

Think of the consequences of a retail implosion due to the deterioration and defaults of consumer credit.... job losses. in fact, the retail sector weighs much more than many will anticipate; it reflects consumer credit AND commercial real estate. less jobs, more small business commercial defaults, and, in a vicious circle, more consumer credit card defaults.

BAM

Thanks for stopping by. I am glad you are enjoying the blog!

JD

Yup

The deleveraging of the consumer is going to be very painful.

Jobless claims soared higher than expected this morning. Of course the market rallied on the news.

What an insane world we all live in! The stupidity of the equity market defies belief.

Post up around 6 :)

What an insane world we all live in! The stupidity of the equity market defies belief.I love your blog, Jeff, but you are definitely not a trader. Made 8% today by going long. Market was way oversold. But feel generally better on the short side. Hope there will be opportunities very shortly. Maybe already tomorrow.

John

Congrats!

Never claimed to be a good trader. Very few are. Always been more of a macro guy as you well know.

GL

Post a Comment