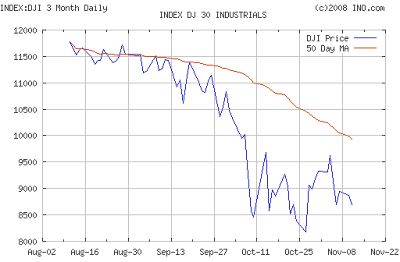

It was another red day on Wall St! The major averages were down about 2%. The charts tell me that its highly likely that we are going to retest the lows. Take a look a 3 month chart of the DOW:

As you can see, we hit the closing low of 8175 in late October. Technicians will tell you that the fact that the bounce up to 9500 didn't hold means that a retest of the 8175 low set in late October is very likely before we move higher.

Here was Art Cashin's take in his daily newsletter this morning(no link, subscription only):

"Cocktail Napkin Charting –

The market continues to offer conflicting alternatives (that's its job, of course). Look at the wicked selloff last Wednesday and Thursday.

Not only was it the worst two day "point" fall in history, they had other rarely seen aspects. As the fabled Bob Farrell points out, they were the first back to back 90% days since 1987. He also notes that both days had Trin readings well over 2.00 (3.88 and 4.06). We have not seen that since the bottoming process back in 2002.

This continuing confluence of rarely seen performances suggests something very powerful is about to happen.

Okay, let's review. Most of the napkins lean toward a probable retest in this bottoming process. To eliminate that likelihood, the bulls would need to rally above 9750. That's a long way off. The bears have a nearer test of direction.

If stocks break Friday's lows (Dow circa 8650 and S&P 900) that could put bears back in the catbird seat.

Additionally, the moving averages have yet to cross each other favorably. Thus, they have yet to verify that a bottom has been put in.

For today, S&P needs support at 907, then 900 and then 880. Resistance looks like 930 then 951. Consensus –

Today's holiday should keep markets illiquid and, therefore, potentially volatile. Stay very, very nimble. Something's building here."

My Take:

I don't know a better trader on the street than Art Cashin. I will take his 5 decades of experience over anyone so I pay close attention to what he says. I thought his writings today were very interesting. Keep in mind this was from this morning so now we can break this down a little further:

Based on his comments above, Art said the bears should be in the catbird seat if we broke 8650 on the DOW and 900 on the S&P. We ended up closing at 8693 and 898 respectively so we broke thru one of the two supports and came very close on the other.

This makes me lean towards another push down to retest 8175 on the DOW before we move higher. Now keep in mind, this was not completely confirmed according to Cashin's cocktail napkin charting so you need to be careful if you are going to play to the downside.

I ended up closing out my SRS today and took some profits, but I kept everything else on. These retests are critical to where we go next. I find Art's prediction that something very big is building to be very ominous.

My guess is if we break through the 2002 lows of 820 on the S&P that things could get very ugly. The bulls would then run for the hills selling on the way out because technically this would a complete failure.

On the bullish side, if the 8175 level holds, we could see a rocket ride north. We are within a day or two of retracing to these levels so you gotta be nimble over the next couple of days as Art warns. We could test the lows tomorrow the way the DOW has been trading so pay attention! We have seen several 600 point down days in the last few months. Another one tomorrow would bring us right to the retest levels.

Bottom Line:

Things were quiet on the news front. The big news was the loan modification program that was announced by the government.

"WASHINGTON (AP) -- Once again, the government has offered another plan to help troubled homeowners. Once again, critics say it doesn't go far enough.

The plan announced Tuesday by federal officials and mortgage giants Fannie Mae and Freddie Mac sounds sweeping in its approach: Borrowers would get reduced interest rates or longer loan terms to make their payments more affordable.

To qualify, borrowers would have to be at least three months behind on their home loans and would have to owe 90 percent or more than the home is worth. Investors who do not occupy their homes would be excluded, as would borrowers who have filed for bankruptcy.

Qualified borrowers would get help in several ways: The interest rate would be reduced so that they would not pay more than 38 percent of their gross income on housing expenses. Another option is for loans to be extended to 40 years from 30, and for some of the principal to be deferred, interest-free."

This was big news today but I consider it to be a non event. Basically all this does is help a bunch of deadbeats that got in over their head when buying a house. I hope they enjoy their new 40 year loan. The owners will be in diapers and eating food with dentures by the time they get their loan paid off.

I will just lump this proposal in with the other loan modifications that I discussed last week. I still predict millions will walk away from their homes. Who wants to live in the same house for 40 years? With all of the job losses that are coming down the pike as the recession deepens, many will be forced to walk away in order to find work. Half of Michigan will walk away if Ford or GM goes down.

Detroit will turn into a giant Flint, MI filled with empty boarded up homes.

When it comes to the market in coming weeks, focus on the technicals. We are approaching some key support levels on the downside as I described before. If we crash right through them expect all hell to break loose. However, I expect the lows to hold for now because we have just entered into the severe part of this recession, and the holidays are coming which are usually slightly helpful to equities.

We have retail numbers still to come this week, and this could be the trigger that gets us down to the 8175 level.

Lets hope the market holds here. If it doesn't we may see The Grinch steal Christmas.

12 comments:

Excellent blog Jeff. Do you trade for your living / full time?

Thanks Growler

I just trade my own book. I am not a certified financial planner or anything like that.

I am lucky to have some strong Wall St connections that help me with this blog. I also spend a lot of time researching.

I hope the information helps!

Futures up 1%. No catbird seat for the bears. LOL

yeah

It looks like we will open up a little green tomorrow. We could bounce sideways tomorrow.

It will be interesting to see if any type of bounce holds. The futures have not been very accurate with what the market does in the first half hour recently.

Monday the futures had us going to the moon. That rally burned out within the firs tcouple hours.

Lots of ridiculous news coming out about the TARP.

Apparently lobbyists are flocking to the Treasury in DC trying to get a piece of the taxpayer pie. even the mariner lobby was asking for the maoney because boat financing has become so difficult.

Amex just secured $3.5 billion from the TARP. This thing has turned into a three ring circus.

Whoever gets turned down could very well blow up.

Lets see how this all plays out. I see potential shoe drops everywhere.

Don't forget we have retail sales this week. I expect those to be a disaster.

Bad retail sales are already priced in. Can it get an worse than CC going belly up?

Jeff,

Your site helps indeed! I too trade "my own book" for my living. I lean heavily on TA but really enjoy hearing the fundamentals from you.

Thanks again

Anon

Apparently so.

Ugly opening today. Best Buy guidance and Goldman downgrade really took the air out of the market this morning.

Down around 2% at the open. Retest highly of 8175 looking highly likely. We might test it today the way we opened.

Who knows in this market. It appears that the consumer has walked off a cliff.

Groeler

Your welcome.

I hope you caught this last leg down. Its been a tough leg to play.

I know some traders that missed it because we are closer to the bottom of the recent trading range.

Lets see where we end up today. The market is jittery as hell. We seem to be recovering a little bit here.

It seems the market can't take much more bad news. Another shoe drop at this point could send us into a tailspin.

I may not be able to hop on again today guys and gals.

I have a bunch of meetings to attend.

I will be back on tomorrow. Good luck today!

Jeff

Ugly Day

Intel missed huge after hours. Expect an ugly day tomorrow at the open.

I will be back tomorrow. We will retest the lows at the open.

Lets see if the recent low of 8175 holds. It will be tested tomorrow.

If we break through then the 2002 lows are next. If that doesn't all bets are off as to how ugly tomorrow.

The TARP is turning into a total cluster f**k... There is a good chance we capitulate tomorrow.

This continuing confluence of rarely seen performances suggests something very powerful is about to happen.

Yes, one of the biggest rebounds that nearly killed me. Another day like this and you can bury me.

anon

HAng in there. Everyone is on edge right now. We have seen this three times so far.

Post will be up around 5-5:30. Working on it now

Post a Comment